IRS $2000 Direct Deposit: Decoding Eligibility and Its Potential Impact

The Digital Mirage: Why 'Free Money' Rumors Spread Like Wildfire, And How We Can Build a More Informed Future

It’s November 2025, and once again, the digital airwaves are buzzing. "$1,390 IRS deposit this week!" scream some headlines, while others promise a cool $2,000 direct deposit, sparking a collective gasp of hope across social media. You’ve probably seen it, a viral post or a forwarded message, promising that much-needed federal stimulus check is just around the corner. But here's the stark, unvarnished truth, the kind of clarity we need to cut through the digital fog: those new federal stimulus payments? They’re a mirage. A powerful, seductive, algorithmically amplified mirage.

When I see these rumors flying around – the breathless whispers about new irs stimulus checks or the specific qualifications for a $2000 direct deposit – I honestly just sit back in my chair, speechless at the sheer velocity of misinformation. It's a fascinating, if frustrating, phenomenon. Our collective memory, still fresh with the genuine relief of COVID-era aid, seems to be a fertile ground for these phantom payments to take root. We remember the past, we yearn for a similar lifeline, and the digital ecosystem, for all its wonders, becomes an echo chamber amplifying every wishful thought and outright fabrication. It's like a digital game of telephone played at warp speed, where a single, unverified whisper can transform into a roaring torrent of "fact" before anyone can even think to hit the pause button and verify.

The Anatomy of a Digital Delusion

So, let's break down this digital illusion, not to simply debunk it, but to understand its mechanics. The IRS has been crystal clear: Congress hasn't authorized any new federal stimulus, and there are no automatic deposits scheduled for November 2025. Period. The last federal economic impact payments were issued back in 2021, and those programs have run their course. We saw a final push for the Recovery Rebate Credit for 2021 tax filers earlier this year, but that deadline sailed past on April 15, 2025. Yet, the rumors persist, fueled by a potent cocktail of outdated news images, state-level benefits being mistaken for federal programs, and, most nefariously, outright scams.

Scammers, those digital parasites, are having a field day, using these false hopes to trick people into sharing personal information – Social Security numbers, bank details, anything they can get their digital claws on. And here’s a crucial piece of knowledge we all need to internalize: the IRS will never initiate contact with you via email, text, or social media. Their first move is always a letter, verifiable through official channels like IRS.gov. This isn't just a technical detail; it's a fundamental firewall against fraud. The challenge, of course, is that our algorithm-driven platforms are often better at amplifying sensational claims than they are at circulating fact checks. It's a race against the clock, and often, the truth just can't keep up with the viral velocity of a compelling, albeit false, promise of a $2000 payment eligibility IRS.

Even the much-discussed "tariff dividend" plan, proposed by former President Donald Trump, suggesting $2,000 payouts funded by federal tariff revenues, remains firmly in the realm of proposal. It’s a concept, an idea floated on Truth Social, but it has no legal backing, no Congressional approval, and frankly, financial experts are skeptical about its feasibility, especially given the Supreme Court's own doubts about the legality of broad tariffs. So, while the idea of a dividend is intriguing, we're miles away from anything concrete.

Reclaiming Our Digital Narrative: The Path Forward

This isn’t just about debunking a rumor; it’s about understanding the very fabric of our digital society. It's a moment for ethical consideration: what is our responsibility when we share information online? Are we contributing to the echo chamber or helping to build bridges of clarity? Just as the printing press, a revolutionary technology, could spread both profound truths and dangerous propaganda, our digital networks hold the same dual power. We have to be the discerning editors of our own feeds, the critical thinkers who ask, "Is this really true?" before we hit share.

What if, instead of chasing phantom stimulus checks, we channeled that collective energy into demanding clearer, more accessible information? What if we leveraged the incredible power of these same algorithms, not to spread false hope, but to highlight verified facts and empower genuine understanding? Imagine a future where our digital tools are so finely tuned, so ethically designed, that they actively guide us towards truth, rather than letting us wander into fields of fiction. This isn't just wishful thinking; it's an engineering challenge, a design imperative, and a societal necessity. We have the collective intelligence to build these systems, to demand transparency, and to foster a culture of critical digital literacy. It’s a paradigm shift, really, from passive consumption to active, informed participation in our shared digital reality. What an exciting prospect, to turn the very platforms that amplify confusion into beacons of clarity!

The Truth Is Our Real Stimulus

Related Articles

US Government Backs Trilogy Metals (TMQ): Why It's Soaring and What It Signals for America's Future

I just read a press release that, on the surface, is about a mining company in Alaska. And I can’t s...

Netflix Stock: The Split Happened. So Why's the Price Still a Joke?

Netflix's 'Accessibility' Charade: Don't Fall for the Stock Split Illusion. Alright, folks, buckle u...

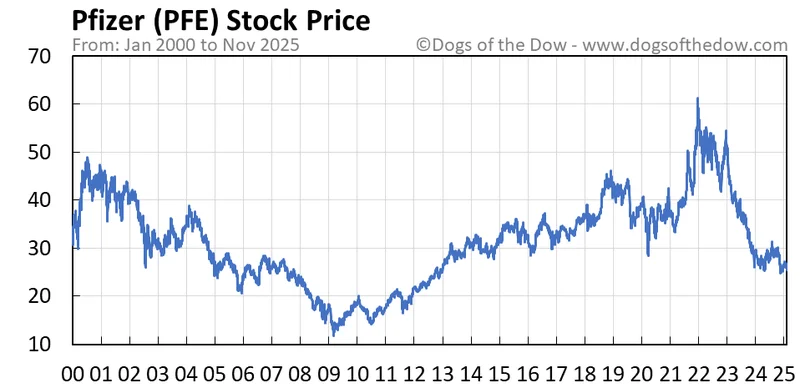

PFE Stock: What the Numbers Actually Say

Pfizer: The Sleeping Giant Ready to Reshape Tomorrow's Health Landscape You know, sometimes the most...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

Denny's $620 Million Deal: What It Means

Denny's Going Private: A $620 Million Gamble on Nostalgia? Denny's, that late-night haven for questi...