PFE Stock: What the Numbers Actually Say

Pfizer: The Sleeping Giant Ready to Reshape Tomorrow's Health Landscape

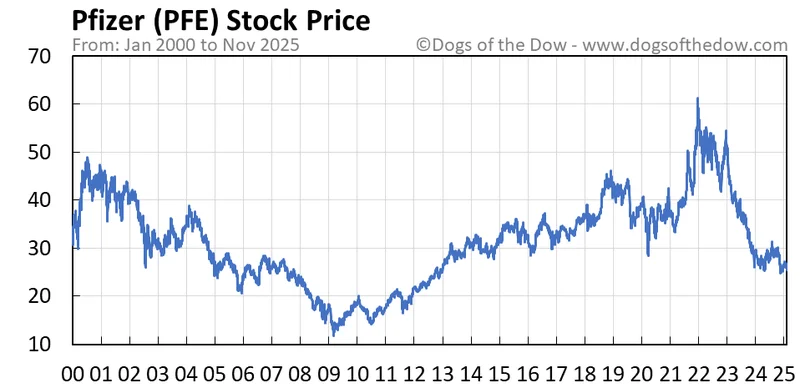

You know, sometimes the most profound shifts happen not with a bang, but with a whisper. On November 10th, Pfizer’s stock nudged up just a tiny fraction, a mere penny, to close at $24.43. For many, that’s just another blip on the screen, a quiet moment in a market often fixated on explosive, overnight gains. But when I look at numbers like these, especially against a backdrop where the broader S&P 500 is barely ticking up and the pharma industry itself is seeing a dip, I honestly feel a thrill. It's like watching the first faint tremors before a massive, tectonic shift begins to reshape the landscape.

We’ve all seen the headlines, haven't we? The post-pandemic skepticism swirling around traditional pharmaceutical companies, a collective sigh of "what's next?" But what if that very skepticism is blinding us to something far more significant? What if the market, in its rush for the new shiny object, is overlooking the foundational strength, the deep-seated innovation, and the quiet, strategic maneuvering of a true titan? This isn't just about a stock moving a few cents; it's about the intricate dance between perception and underlying value, a dance where the smart money is already moving with a silent, confident rhythm.

The Quiet Accumulation: Where Vision Meets Valuation

Think about it. Pfizer, a company with a market cap that towers around $138 billion, has been trading at what many are calling historically attractive valuations. Pfizer Inc. (PFE) is Attracting Investor Attention: Here is What You Should Know. It's like a vintage supercar, temporarily undervalued because the latest model just rolled off the assembly line. The engine is still roaring, the craftsmanship is undeniable, but people are distracted by the new paint job elsewhere. This isn't just my gut feeling; the data is screaming it. Market analysts are whispering about Pfizer as a "mean-reversion candidate," a compelling contrarian play. Pfizer (PFE) stock poised for potential turnaround. And when you see institutional investors, the ones with the deepest pockets and the longest time horizons, reportedly accumulating shares, recognizing these valuation disparities as prime entry points, you've got to ask yourself: what do they see that the casual observer is missing?

It reminds me of the early days of the internet, when skeptics scoffed at the idea of information traveling at light speed, dismissing it as a niche for academics. They couldn't see the paradigm shift coming, the way it would fundamentally alter commerce, communication, and human connection. Pfizer, right now, feels a bit like that — a foundational technology, in this case, a foundational health technology company, being underestimated. And let's not forget that robust dividend policy, yielding an eye-watering 7.04% with a quarterly distribution of $0.43 per share. That's not just a payout; it's a declaration of commitment, a steady heartbeat of reliable cash flow that offers both downside protection and a clear signal of financial health. It’s like a lighthouse in a stormy sea, guiding income-focused investors to a safe harbor. But beyond the safety, what does it truly signify about management's confidence in the future? Could this quiet accumulation be the seismic rumble before a major market shift, or are we simply witnessing the patient re-evaluation of a cornerstone of global health?

Beyond the Balance Sheet: Catalysts for a Healthier Tomorrow

Now, let's talk about the future, because that’s where the real excitement lies. Pfizer isn't just resting on its laurels; it’s a beehive of activity, buzzing with research and development across therapeutic areas that will define the next generation of medicine. We’re talking about upcoming pipeline updates and guidance revisions that are poised to be genuine catalysts, not just incremental improvements. Management is actively implementing cost-cutting initiatives and portfolio optimization strategies, which, in simpler terms, means they're ruthlessly streamlining operations and making sure every dollar spent is maximizing impact, preparing for a lean, efficient future where innovation can truly thrive without unnecessary drag.

And imagine the possibilities from partnership opportunities and licensing agreements! These aren't just business deals; they're collaborations that can accelerate breakthroughs, combining Pfizer's immense resources and expertise with agile, cutting-edge discoveries from smaller players. The speed of this is just staggering—it means the gap between today and tomorrow, between a lab discovery and a life-changing treatment, is closing faster than we can even comprehend, and that's a truly exhilarating prospect for human well-being across the globe. When I consider the sheer scale of their R&D, the strategic partnerships, and the recent Q3 earnings beat by an impressive 32%, it's clear this isn't a company treading water; it's a company building an entirely new vessel for the future of health. Of course, with such immense power to shape human lives comes immense responsibility. We must always ensure that the pursuit of profit is balanced with an unwavering commitment to equitable access and ethical innovation, because the greatest breakthroughs are those that serve all of humanity.

The Dawn of a New Era for Global Health

We're standing at a fascinating crossroads, aren't we? The market's short-term focus often misses the grander narrative, the long game being played by companies like Pfizer. This isn't just about a stock price; it's about the enduring power of innovation, the unwavering commitment to health, and the strategic foresight to navigate complex times. Pfizer's story isn't over; it's just entering a new, incredibly promising chapter. This is the kind of breakthrough that reminds me why I got into this field in the first first place—to witness and help usher in a better, healthier future.

Related Articles

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Verizon Layoffs: Unpacking the CEO's Vision and the 2025 Horizon – What Reddit is Saying

The air around big tech and telecom giants lately? It’s been thick with a kind of nervous energy, a...

hims stock: What's driving the after-hours moves?

Hims & Hers Health (HIMS) saw some notable after-hours stock movement on Monday, November 3, 2025. B...