Denny's $620 Million Deal: What It Means

Denny's Going Private: A $620 Million Gamble on Nostalgia?

Denny's, that late-night haven for questionable decisions and even more questionable food, is going private. A group of investors, including Yadav Enterprises and TriArtisan Capital Advisors (who also own TGI Friday's and P.F. Chang's – a diverse portfolio, to say the least), is buying the diner chain for a cool $620 million. The deal, expected to close in early 2026, will give stockholders $6.25 per share, a significant jump from its market value before the announcement.

But let's be clear: this isn't some triumphant return to glory. Denny's has been struggling. The company closed over 180 restaurants since late 2024. In March 2025, they announced the closure of 70 to 90 restaurants, a substantial increase from the 32 closures initially projected for 2024 (they ended up closing 88). So, why the sudden interest from investors?

The Allure of Private Ownership

The official line, of course, is that going private will free Denny's from the tyranny of Wall Street's quarterly earnings expectations. Public companies are constantly pressured to show growth, which can lead to short-sighted decisions. A privately owned company, in theory, can focus on long-term strategy without the constant scrutiny.

That's the pitch, anyway. The reality is likely more complex. Going private means fewer regulations, less transparency, and more control for the investors. It's a chance to restructure, rebrand, and potentially reposition Denny's without having to answer to public shareholders at every turn. It's like taking a fixer-upper off the market – you can finally renovate without the neighbors peering in.

The $620 million valuation represents a 52.1% premium over Denny's market value on November 3rd. A hefty premium, no doubt. But is it justified? Denny's operates 1,278 locations in the US, 73 of which are in Arizona. That's a lot of real estate, a lot of brand recognition, and a lot of potential for a turnaround. But potential doesn't guarantee success.

One has to wonder, though: what exactly is the plan here? Is it a complete overhaul, a nostalgic revival, or simply a cost-cutting exercise designed to squeeze out a few more years of profit before the diner chain fades into oblivion? Details on the investors' specific strategy remain scarce.

A Breakfast Battleground

Denny's isn't operating in a vacuum. The breakfast and brunch market is fiercely competitive, with trendy new restaurants and established chains all vying for a piece of the pancake pie. Denny's has struggled to differentiate itself, often relying on its legacy and late-night appeal rather than innovation or culinary excellence.

And this is the part of the analysis that I find genuinely puzzling. The restaurant industry is notorious for its fickle consumers, and brand loyalty is a rare commodity. What makes these investors believe they can turn around a struggling diner chain in a market that's only getting more crowded? Are they banking on a resurgence of retro dining, a return to simpler times? Or do they see an opportunity to leverage Denny's existing infrastructure and brand recognition to launch a new concept altogether?

The stock price jumped almost 50% on November 4th after the deal was announced. Before that, it had lost about a third of its value during 2025. That volatility speaks volumes about the market's uncertainty regarding Denny's future. Shares will continue to be traded until the deal closes in early 2026.

It's worth remembering that Yadav Enterprises is one of Denny's largest franchise operators. Their involvement suggests a degree of insider knowledge and a belief in the brand's underlying potential. But even the most optimistic franchisee can't single-handedly revive a struggling chain.

Is This Really About Pancakes?

Ultimately, the Denny's acquisition is a bet on nostalgia, on the enduring appeal of a classic American diner. It's a gamble that consumers are craving comfort food and familiar faces in an increasingly complex world. But nostalgia alone isn't enough. Denny's needs a clear vision, a strong strategy, and a willingness to adapt to the changing tastes of its customers. Whether these investors can deliver that remains to be seen. The acquisition cost was substantial (reported at $620 million). Spartanburg-based Denny's is going private in $620 million deal. What to know

A Recipe for Disaster, or a Second Helping?

Related Articles

Immaculata's Open House: A Data-Driven Breakdown for Prospective Students

On the surface, the announcement is unremarkable. Immaculata University, a private institution nestl...

Verizon Layoffs: Unpacking the CEO's Vision and the 2025 Horizon – What Reddit is Saying

The air around big tech and telecom giants lately? It’s been thick with a kind of nervous energy, a...

That VTI 'What If' Article: Why It's Mostly Garbage

So, I pulled up my portfolio this morning. September 4, 2025. Ten years to the day since I dropped a...

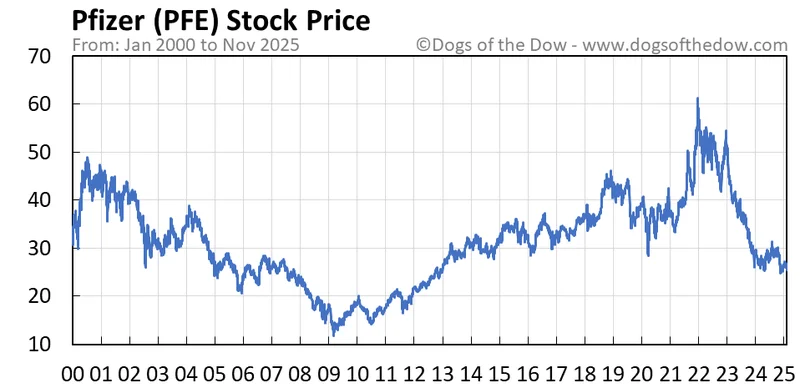

PFE Stock: What the Numbers Actually Say

Pfizer: The Sleeping Giant Ready to Reshape Tomorrow's Health Landscape You know, sometimes the most...

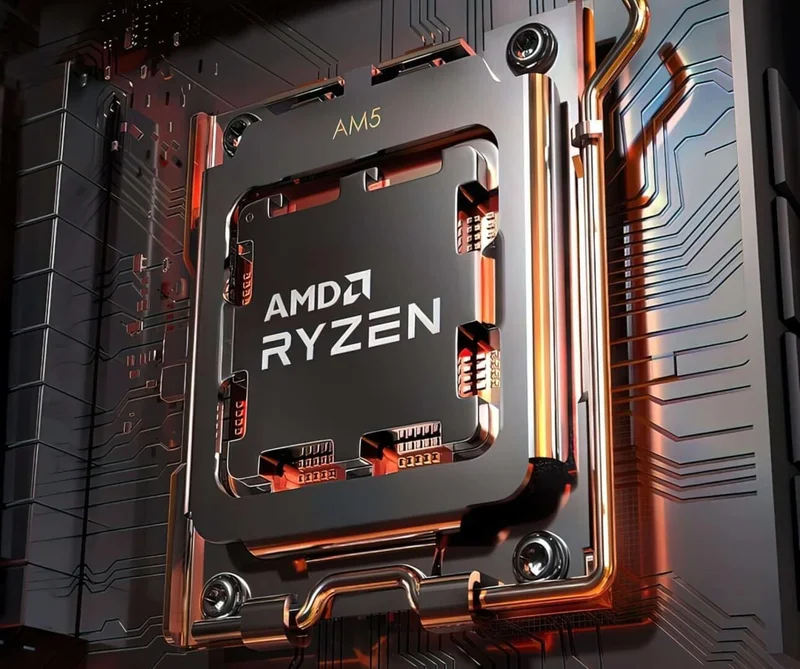

AMD's Data Center Brain Drain: What's the Stock Price Doing?

Generated Title: AMD's Poaching Intel's Talent: Desperation or Genius? Another One Bites the Dust at...

Altcoins: Zcash, Astar, Solana and the Santa Rally Question: The Data-Driven Outlook

Santa's Crypto Rally: Fact, Fiction, or Just Wishful Thinking? Santa's Crypto Bag: A Data Dive The...