Hood Stock: Should You Buy the Dip and What You Need to Know

Alright, let's get this straight. Robinhood, the app that gamified investing for the masses, is now trading at $115 a share? After the meme stock circus and the regulatory beatdown? Give me a freakin' break.

The "Turnaround" Narrative: Smoke and Mirrors?

They're spinning this as some kind of epic turnaround story. "Oh, Robinhood has transformed its business!" they say. Transformed into what? A slightly less chaotic version of the same casino?

The secret sauce? High-yield accounts. Basically, they're bribing people to park their cash on the platform. And hey, it's working. Assets have ballooned from $102 billion to $343 billion. But is that real growth, or just a temporary sugar rush fueled by inflated interest rates? What happens when rates come back down to earth? Does everyone pull their money out, leaving Robinhood high and dry? I'm just asking questions here.

And don't even get me started on the Robinhood Gold membership. $5 a month to "earn higher interest rates and other benefits"? It's like charging people extra for slightly better odds at the same rigged game.

Solid Earnings? Or Just Smoke and Mirrors?

Okay, fine, the recent quarterly results looked good. Revenue up, earnings up, all that jazz. But let's dig a little deeper, shall we?

Transaction-based revenue surged, thanks to crypto, options, and equities. Translation: people are still gambling like crazy on volatile assets. And Robinhood is raking in the dough from every trade, win or lose. It's the house, always winning.

Average revenue per user (ARPU) jumped 82% to $191. That means they're squeezing more money out of each customer. Good for them, bad for us.

Net interest revenue increased 66% to $456 million. Again, thanks to those juicy interest rates that are luring in the cash. But how sustainable is this? What's the long game here? Or is there even a long game?

Offcourse, they're rolling out new features, too. Prediction markets, private equity access for retail investors... It all sounds fancy, but it's just more ways to separate people from their money.

A Brief Detour into My Personal Hell

Speaking of separating people from their money, have you seen the price of avocados lately? I swear, it's like they're trying to bankrupt me one overpriced toast at a time. And don't even get me started on streaming services. It's death by a thousand subscriptions.

The $1 Million Question: Can Robinhood Really Set You Up For Life?

The article throws out this hypothetical: invest $10,000 in Robinhood today, and you'd need a 26% compound annual growth rate for the next 20 years to hit $1 million. 26%? For twenty years straight? That's not investing, that's a freakin' miracle.

They admit that relying on a single stock is a "tall task." Ya think?

And then they say, "I like Robinhood and think it has solid growth potential." Wait, what? After all that skepticism, all that cynicism, they're suddenly optimistic? Talk about a whiplash.

They also say, "The stock isn't cheap, priced at 47 times this year's projected earnings per share." Translation: it's overvalued, and the market is already pricing in a lot of future growth. So, where's the upside?

They conclude by saying that Robinhood is a good "small piece of a well-diversified portfolio." Which is basically code for: "Don't bet the farm on this, folks."

But here's the thing: if you need a 26% annual return to reach your goals, you're probably already screwed. And Robinhood ain't gonna save you. It's just another tool in the Wall Street machine, designed to extract wealth from the masses, not create it.

So, What's the Real Story?

Robinhood is a flashy, addictive platform that preys on people's greed and FOMO. It might make you a quick buck, but it's more likely to leave you broke and disillusioned. Investing in it now? You might as well just flush your money down the toilet.

Related Articles

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

LendingTree's CEO is Dead: Let's Talk About the Real Fallout

The Visionary is Dead. The Press Release Was Ready. One minute, you’re a 55-year-old tech founder ri...

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

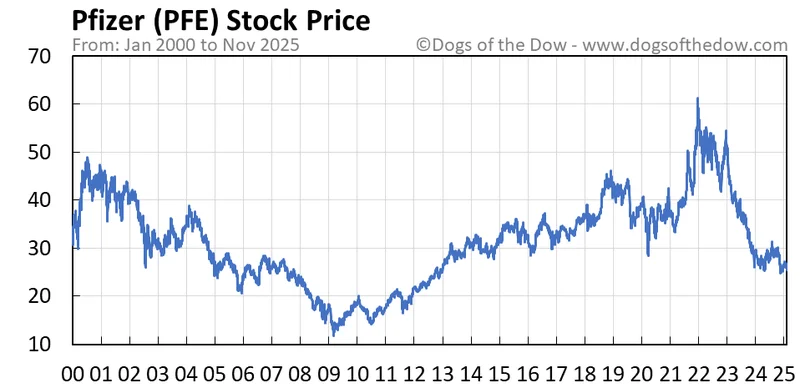

PFE Stock: What the Numbers Actually Say

Pfizer: The Sleeping Giant Ready to Reshape Tomorrow's Health Landscape You know, sometimes the most...

QCOM Stock Price: What's Driving It vs. NVDA and AMD?

Qualcomm's Stock: Is It Finally Time to Jump Ship? Alright, let's get real about Qualcomm. QCOM stoc...

Dan Schulman Named New Verizon CEO: What His PayPal Past Means for Verizon's Future

Verizon’s New CEO Isn’t About 5G. It’s About a Quiet Panic. The market’s reaction to the news was, i...