Consumer Sentiment Weakens: What It Means for Spending Habits and the Definition of "Consumer

Consumer Confidence Plummets: Is This the Canary in the Coal Mine?

Americans are feeling the pinch. A new study reveals consumer sentiment has weakened to its lowest level in nearly 3.5 years. That's not just a headline; it's a potential economic earthquake. As someone who used to sift through mountains of financial data, I can tell you that consumer confidence is more than just a feeling—it’s a leading indicator.

The Numbers Don't Lie (Usually)

The report itself is a single data point, of course, and we have to be careful about overreacting to single data points. But still: a dip this significant raises some serious questions. What's driving this pessimism? Is it inflation, which, despite what the Fed wants you to believe, hasn't truly gone away? Or is it something deeper, a fundamental lack of faith in the economy's long-term prospects? (The report doesn't drill down into specifics, which is a missed opportunity.)

One thing I've learned is that you can't just look at the headline number. You need to dig into the underlying data. Are certain demographics feeling the pinch more than others? Are there regional disparities? Without that granular level of detail, it's hard to get a true picture of what's going on. Are we talking about a broad-based decline, or is it concentrated in specific sectors?

Beyond the Survey: Anecdotal Evidence

Of course, surveys are just surveys. They capture a snapshot in time, but they don't always reflect reality on the ground. That's why I also pay attention to anecdotal evidence. What are people saying online? What are they complaining about on social media? This kind of qualitative data can provide valuable insights that surveys miss.

I see a lot of chatter about rising prices, stagnant wages, and job insecurity. People are worried about the future, and that worry is translating into a reluctance to spend money. It's a vicious cycle: as consumer spending declines, businesses suffer, and the economy slows down even further. But how much of this is genuine economic anxiety, and how much is just noise amplified by social media echo chambers? It's hard to say for sure, but the volume of complaints is hard to ignore.

I've looked at hundreds of these sentiment reports, and one thing I've noticed is that people's expectations often lag behind reality. Even when the economy is improving, it can take a while for people's attitudes to catch up. Conversely, when the economy starts to decline, it can take a while for people to realize it. So, this dip in consumer confidence could be a sign that the economy is already in worse shape than we think. Or, it could just be a temporary blip.

The Canary's Song

The question, then, is whether this decline in consumer confidence is a warning sign of something more serious. Is it the canary in the coal mine, signaling that a recession is on the horizon? Or is it just a temporary setback, a bump in the road on the path to recovery?

The answer, unfortunately, is that we don't know for sure. Economic forecasting is a notoriously unreliable business. But one thing is clear: this decline in consumer confidence is something we need to take seriously. It's a reminder that the economy is fragile, and that even small shocks can have big consequences. What policies, if any, could reverse this trend? Are we looking at a structural shift in consumer behavior, or is this just a cyclical downturn?

A Self-Fulfilling Prophecy?

Consumer confidence is a bit like a soufflé. If you open the oven door too soon, it collapses. If people lose faith in the economy, they stop spending money, and that can lead to a self-fulfilling prophecy. The key is to maintain confidence, even in the face of uncertainty. But how do you do that when the data is telling you something different? That's the million-dollar question.

The Data Sounds an Alarm

The drop isn't just a blip; it's a flashing red light on the economic dashboard. Time to pay attention. Consumer Sentiment Weakens To Lowest Level In Nearly 3.5 Years, New Study Shows

Related Articles

Comerica Bank: Near Me, Numbers, and...Mergers?

Generated Title: Comerica Bank: Still Kicking, or Kicking the Bucket? So, Comerica Bank. Still a thi...

QCOM Stock Price: What's Driving It vs. NVDA and AMD?

Qualcomm's Stock: Is It Finally Time to Jump Ship? Alright, let's get real about Qualcomm. QCOM stoc...

The VIX Name is a Complete Mess: What the Streaming Service Is vs. That Stock Market Thing

So, the market’s "fear gauge" finally decided to show a pulse. Give me a break. On Friday, the VIX s...

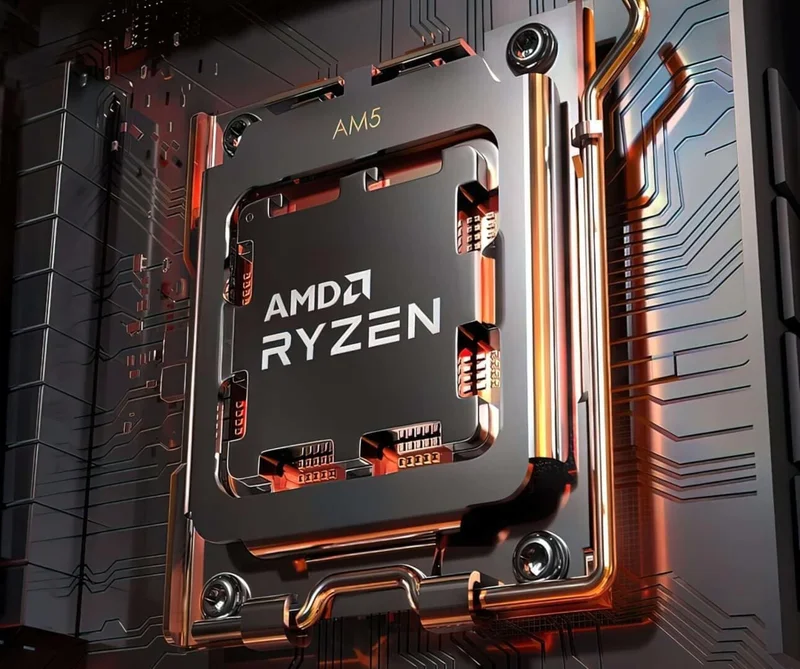

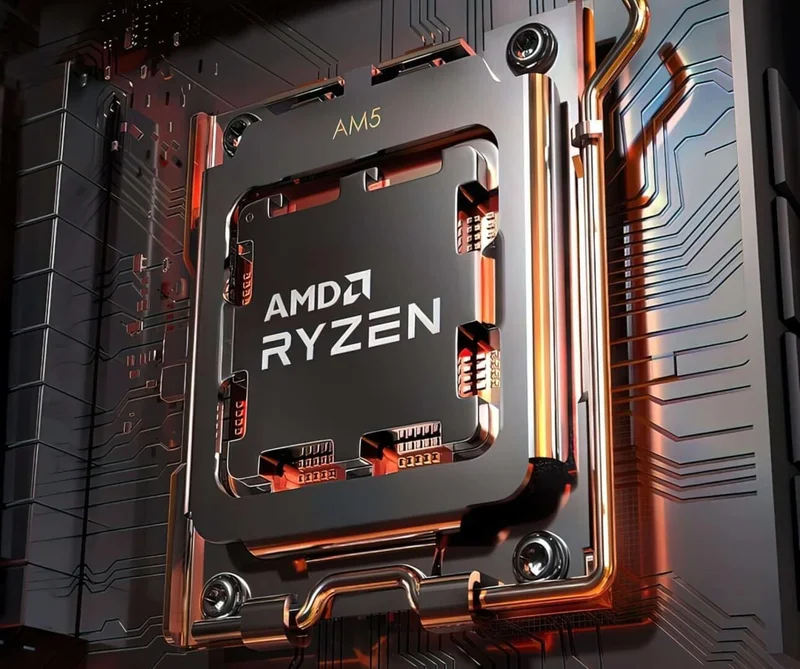

AMD Earnings: What Happened and What We Know

AMD's Earnings: Not Just Numbers, But a Glimpse Into Our AI-Powered Future Okay, buckle up, everyone...

AMD's Data Center Brain Drain: What's the Stock Price Doing?

Generated Title: AMD's Poaching Intel's Talent: Desperation or Genius? Another One Bites the Dust at...

Verizon Layoffs: Unpacking the CEO's Vision and the 2025 Horizon – What Reddit is Saying

The air around big tech and telecom giants lately? It’s been thick with a kind of nervous energy, a...